real estate & finance news

Let's Get You Approved!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Protecting Yourself from Mortgage Wire Fraud

Mortgage wire fraud is a serious real estate scam

where fraudsters deceive homebuyers into wiring their closing costs or down payments to fraudulent accounts. This increasingly common fraud can lead to significant financial losses for victims. Here's a detailed overview of how it works, how to prevent it, and what to do if you become a victim.

How Mortgage Wire Fraud Works

The Scam Process

Phishing and Spoofing: Scammers initiate the process by sending emails that appear to come from legitimate sources such as real estate agents, title companies, or lenders. These emails might contain malware or links that give fraudsters access to email accounts and sensitive information once clicked.

Gathering Information: After gaining access, scammers monitor communications to identify upcoming real estate transactions. They gather details about the buyer, the transaction, and the closing process to make their fraudulent communications seem credible.

Sending Fake Instructions: As the closing date approaches, scammers send an email or make a call posing as a trusted party involved in the transaction. They provide new wiring instructions, often citing a last-minute change.

Executing the Fraud: The buyer, believing the instructions are legitimate, wires the funds to the fraudster’s account. The money is then quickly withdrawn or transferred to other accounts, making recovery difficult.

Common Tactics

Urgency and Pressure: Scammers create a sense of urgency, claiming that the transaction will fail if the funds are not wired immediately.

Legitimate-Looking Communications: They use email addresses and phone numbers that closely resemble those of legitimate parties, sometimes using spoofing software to mimic real contact details.

How to Prevent Mortgage Wire Fraud

As a homebuyer, confirming the authenticity of wiring instructions is crucial. Here are the best practices to ensure the wiring instructions you receive are legitimate:

Best Practices for Confirming Wiring Instructions

Verify Instructions Verbally

Call Using Trusted Numbers: Always call your real estate agent, title company, or lender using phone numbers you received and verified at the beginning of the transaction. Do not use the contact information provided in the email or message with the new instructions.In-Person Verification: If possible, verify wiring instructions in person with your real estate agent or title company.

Be Suspicious of Last-Minute Changes

Rare Changes: Treat any last-minute changes to wiring instructions with suspicion. Legitimate changes are rare and should only come from your closing agent.

Timing of Requests: Be particularly cautious of changes requested on Fridays or before holidays, as fraudsters often time their requests to make it harder to recover funds.

Use Secure Communication

Avoid Email for Sensitive Information: Do not discuss financial details or send sensitive information via email. Use secure methods of communication whenever possible.

Forward, Don’t Reply: When responding to emails, use the “forward” function instead of “reply” and type in a trusted email address. This reduces the risk of replying to a spoofed email address.

Check for Irregularities

Email Addresses: Carefully check the sender’s email address for any discrepancies or slight alterations. Fraudsters often use email addresses that look very similar to legitimate ones.

Content Quality: Look for poor grammar, spelling mistakes, or unusual phrases in the email. Professional communications are typically well-written and free of errors.

Confirm with Your Bank

Account Verification: Ask your bank to confirm the name on the receiving account before sending a wire. This adds an extra layer of verification.

Post-Transfer Confirmation: After wiring the funds, verify with your title company that they have received the wire within a few hours of the transfer.

Secure Your Devices

Device Security: Ensure your computer, phone, and other devices are secure. Use strong passwords, update software regularly, and avoid using public Wi-Fi for sensitive transactions.

Educate Yourself

Understand the Process: Familiarize yourself with the closing process and the typical steps involved. Knowing what to expect can help you identify any irregularities.

By following these best practices, you can significantly reduce the risk of falling victim to mortgage wire fraud. Always take the time to verify wiring instructions through trusted and secure methods to protect your investment.

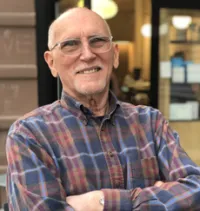

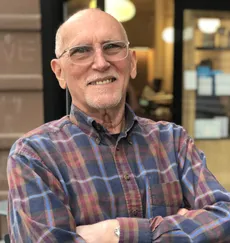

NMLS 375548

“Every Client Deserves The Best Terms & Service Possible.”

Lee Walsh,

Founder Radar Mortgage, LLC

Our goal is simply to be the trusted real estate finance advisors of our community.

© Copyright 2018-2026. Radar Mortgage, LLC. All rights reserved. Visit the Nationwide Mortgage Licensing System NMLS 1708706

Radar Mortgage, LLC makes residential, commercial, and business purpose loans. Commercial and Business loans are for investment purposes only and not for personal, family, or household use. Loan product availability may be limited or not available in certain states. This is not a commitment to lend. All loans are subject to borrower underwriting and credit approval, in Radar Mortgage, LLC’s sole and absolute discretion. Other restrictions apply.

Important Disclosures