real estate & finance news

Let's Get You Approved!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Power of the Permanent Rate Buydown

Learn why a rate buydown concession is more powerful than a price cut when buying a home. Discover how lower monthly payments and long-term savings can benefit your financial future. Contact Radar Mor... ...more

New Homebuyer ,RealEstateEducation

October 15, 2024•4 min read

Unlock More Buyer Interest with This Simple Strategy (Hint: It’s Not a Price Drop)

Cutting the price to attract buyers? There’s a smarter way to boost appeal without sacrificing your seller's profit. Discover how offering a rate buydown can make your listing more attractive while ke... ...more

New Homebuyer ,RealEstateEducation

September 27, 2024•3 min read

Unlock the Secret to Affordable Homeownership

Unlock affordable homeownership with a seller-paid rate buydown. This strategy slashes monthly mortgage payments and long-term costs. On a $410,000 home, reducing the rate from 6% to 5.25% saves $200/... ...more

FHA ,New Homebuyer

September 21, 2024•3 min read

Protecting Yourself from Mortgage Wire Fraud

As a homebuyer, confirming the authenticity of wiring instructions is crucial to prevent falling victim to mortgage wire fraud. Here are the best practices to ensure the wiring instructions you receiv... ...more

FHA ,fix and Flip New Homebuyer Rental Property &RealEstateEducation

June 19, 2024•3 min read

Innovative Financing: Embracing New Mortgage Solutions for the Self-Employed Homebuyer

Explore cutting-edge mortgage options designed to level the playing field for self-employed individuals seeking to turn their homeownership dreams into reality. ...more

New Homebuyer ,Rental Property

April 03, 2024•1 min read

Mastering Mortgage Approval: Strategic Tips for Self-Employed Buyers Facing Income Variability

Gain valuable strategies to enhance your mortgage approval odds despite the income fluctuations common for self-employed professionals. ...more

New Homebuyer ,Rental Property

March 26, 2024•1 min read

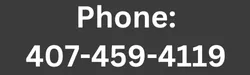

NMLS 375548

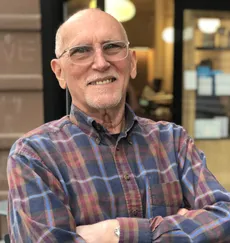

“Every Client Deserves The Best Terms & Service Possible.”

Lee Walsh,

Founder Radar Mortgage, LLC

Our goal is simply to be the trusted real estate finance advisors of our community.

© Copyright 2018-2026. Radar Mortgage, LLC. All rights reserved. Visit the Nationwide Mortgage Licensing System NMLS 1708706

Radar Mortgage, LLC makes residential, commercial, and business purpose loans. Commercial and Business loans are for investment purposes only and not for personal, family, or household use. Loan product availability may be limited or not available in certain states. This is not a commitment to lend. All loans are subject to borrower underwriting and credit approval, in Radar Mortgage, LLC’s sole and absolute discretion. Other restrictions apply.

Important Disclosures