real estate & finance news

Let's Get You Approved!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Unlock More Buyer Interest with This Simple Strategy (Hint: It’s Not a Price Drop)

How Offering a Rate Buydown Can Attract More Buyers Than Lowering the Asking Price

In today’s competitive real estate market, listing agents are constantly seeking ways to make their properties stand out. One of the most effective tools at your disposal is offering a seller concession, particularly a rate buydown. A rate buydown is when the seller pays to lower the buyer’s mortgage interest rate, making the home more affordable for buyers over time. While lowering the asking price is a common strategy, offering a rate buydown delivers far more value to both the seller and potential buyers. Here’s why it’s the better option.

Why a Rate Buydown is More Beneficial Than Lowering the Asking Price

When considering how to attract buyers, many sellers lean toward reducing the asking price of the home. While this can generate more interest, it also comes with a few notable downsides. Lowering the price can create the perception that there’s something wrong with the property or that it’s overpriced in its current condition. This stigma can lead potential buyers to hesitate, thinking they can negotiate even further on price.

In addition, reducing the asking price directly impacts the seller’s profit. For example, reducing the price by $20,000 immediately lowers the seller’s bottom line by that amount. In contrast, buying down the buyer’s interest rate helps maintain the original asking price, preserving the home’s perceived value. Buyers often view properties priced according to market value as more desirable, and a rate buydown sweetens the deal without raising red flags.

Increased Affordability and Buyer Appeal

The main advantage of a rate buydown is the significant impact it has on the buyer’s monthly mortgage payments. By lowering the interest rate, you make the home more affordable without cutting into the seller’s profit. For example, offering a 2% contribution toward a rate buydown might cost the seller $8,200 on a $410,000 home. In contrast, lowering the price by $20,000 costs far more and offers less benefit to the buyer in the long run.

With a reduced interest rate, the buyer’s monthly payments are lower, making the property more financially accessible and attractive. A lower mortgage rate also appeals to buyers who are more concerned with long-term affordability rather than immediate price reductions. This can speed up the selling process, as buyers are more likely to choose a property that offers long-term financial benefits over one with a modest price cut.

Tax Benefits for the Seller

In addition to preserving the home’s asking price and making the property more appealing to buyers, a rate buydown can also offer tax advantages for the seller. When a seller pays points to lower the buyer’s interest rate, those costs may be considered selling expenses, which could be deductible when calculating taxes. This deduction can help reduce the seller’s overall tax liability, making it an even more attractive strategy.

As with any tax-related decision, it’s essential to consult a tax expert to fully understand the potential benefits. However, the possibility of lowering tax liability while offering a compelling financial incentive to buyers is a win-win situation for sellers.

Final Thoughts

Offering a rate buydown is a strategic concession that benefits both sellers and buyers. It allows sellers to maintain the home’s perceived value by keeping the asking price intact, saves more money compared to reducing the price, and enhances the property’s appeal by making it more affordable for buyers through lower monthly mortgage payments. In addition, the potential tax benefits associated with buying down the rate can further sweeten the deal for sellers.

For listing agents looking to close deals faster and get the most out of their sales, a rate buydown is a smart alternative to lowering the price. By providing long-term affordability to buyers and preserving the seller’s profit, this approach maximizes the chances of a successful and timely sale. Let’s talk – it all starts with a conversation! Contact me at [email protected] to explore how a rate buydown can work for your next listing.

NMLS 375548

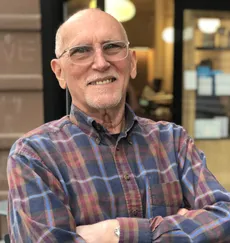

“Every Client Deserves The Best Terms & Service Possible.”

Lee Walsh,

Founder Radar Mortgage, LLC

Our goal is simply to be the trusted real estate finance advisors of our community.

© Copyright 2025. Radar Mortgage, LLC. All rights reserved. Visit the Nationwide Mortgage Licensing System NMLS 1708706

Radar Mortgage, LLC makes residential, commercial, and business purpose loans. Commercial and Business loans are for investment purposes only and not for personal, family, or household use. Loan product availability may be limited or not available in certain states. This is not a commitment to lend. All loans are subject to borrower underwriting and credit approval, in Radar Mortgage, LLC’s sole and absolute discretion. Other restrictions apply.

Important Disclosures