real estate & finance news

Let's Get You Approved!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.

Power of the Permanent Rate Buydown

When it comes to securing the best financial deal for a home purchase, the choice between a price reduction and a rate buydown can make a significant difference in long-term savings. While many buyers are tempted by the allure of a lower purchase price, the reality is that a permanent interest rate buydown can offer far greater savings over time. Here’s why opting for a rate buydown concession, rather than a price cut, is often the smarter financial move.

The Power of the Permanent Rate Buydown

Let’s start with the numbers. Consider two scenarios for a $350,000 home with a 30-year mortgage. In one scenario, the buyer receives a 5% price reduction, bringing the home price to $332,500. In the other scenario, the buyer opts for a 1% interest rate reduction. While the price cut reduces the monthly payment slightly, the interest rate reduction yields far more substantial savings.

With a 1% interest rate reduction, the buyer's monthly principal and interest payment would drop from $2,240.11 to $2,020.31—a difference of $219.80 per month. In contrast, the 5% price reduction only decreases the monthly payment by $112.00. Over five years, the savings from the rate buydown add up to $13,188 compared to just $6,720 with the price reduction. This nearly doubles the savings, demonstrating that a lower interest rate packs more punch than a price cut when it comes to monthly savings.

Why Monthly Savings Matter More

When buying a home, buyers often focus on the immediate impact of a lower price, which can result in a slightly smaller down payment and reduced closing costs. However, the long-term financial picture is shaped by the mortgage payments, which last for decades. A lower monthly payment, achieved through a rate buydown, provides ongoing financial relief that compounds over time.

For example, with a lower monthly payment, homeowners have more flexibility to allocate funds toward other financial goals, such as saving for retirement, investing in upgrades for the home, or building an emergency fund. In contrast, a one-time price reduction offers a temporary benefit that doesn’t provide the same lasting financial ease.

Long-Term Benefits: Equity and Appreciation

Another factor that makes the rate buydown more advantageous is its impact on home equity. A lower interest rate allows more of each monthly payment to go toward the principal balance, helping you build equity faster. This is particularly important as home values appreciate. Over a five-year period, the buyer who opts for the rate buydown ends up with greater equity in their home compared to the buyer who took the price reduction. In our $350,000 example, the buyer with the 1% rate reduction gains $95,866 in equity over five years, compared to $87,726 for the buyer with the price cut.

This increased equity not only strengthens the homeowner’s financial position but also enhances their borrowing power in the future, should they need to access the equity through a home equity loan or refinance.

Why Sellers May Agree to a Rate Buydown

Homebuyers aren’t the only ones who benefit from a rate buydown. Sellers, too, have an incentive to offer this concession rather than reducing the price of the home. By funding a rate buydown, sellers can make their property more affordable to potential buyers without lowering the listing price. This helps maintain property values in the neighborhood and protects the seller’s bottom line.

Negotiating for a seller-paid rate buydown can be a win-win strategy. Buyers secure lower monthly payments, and sellers can still sell their home for close to the asking price. This strategy is especially effective in competitive markets where homes are moving quickly, and buyers are looking for ways to make their offer more appealing.

Make the Smarter Choice: Opt for a Rate Buydown

The financial advantages of a permanent rate buydown are clear: greater monthly savings, faster equity growth, and long-term financial stability. While a price reduction may seem appealing at first glance, it doesn’t offer the same level of impact when it comes to your monthly budget or overall financial health. By focusing on the long-term benefits of lower mortgage payments, homebuyers can secure a more stable and affordable future.

Take the first step toward smarter home financing. At Radar Mortgage, we specialize in crafting personalized financing solutions that maximize your savings and minimize your stress. Our expert team will guide you through every step of the process, ensuring you make the best financial decision for your unique needs.

Ready to explore your options? Schedule a consultation today and discover how a rate buydown can help you save more on your dream home. Your future deserves more than just a price cut—let’s make sure your mortgage works as hard as you do.

NMLS 375548

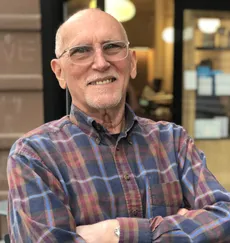

“Every Client Deserves The Best Terms & Service Possible.”

Lee Walsh,

Founder Radar Mortgage, LLC

Our goal is simply to be the trusted real estate finance advisors of our community.

© Copyright 2025. Radar Mortgage, LLC. All rights reserved. Visit the Nationwide Mortgage Licensing System NMLS 1708706

Radar Mortgage, LLC makes residential, commercial, and business purpose loans. Commercial and Business loans are for investment purposes only and not for personal, family, or household use. Loan product availability may be limited or not available in certain states. This is not a commitment to lend. All loans are subject to borrower underwriting and credit approval, in Radar Mortgage, LLC’s sole and absolute discretion. Other restrictions apply.

Important Disclosures